(Posted March 2024)

Procedures have appeared on every Common Final Examination (CFE) Day 2 case in the Assurance role and many CFE Day 3 cases since the first CFE in September 2015. Even though it is likely that candidates will have to design procedures regardless of their role, many still struggle to develop depth and breadth for this commonly tested topic. In this post, we answer many of the frequently asked questions about procedures on the CFE so you can write with confidence.

What types of procedures are tested on the CFE?

Procedures can be tested in a variety of ways, so you need to adapt to the case rather than apply the same template approach each time. We have seen:

- Audit or review procedures for accounting errors

- Audit or review procedures for high-risk areas

- Audit or review procedures requested for specific financial statement areas or accounts

- Audit or review procedures for special engagements (e.g., government grant requirements, financing agreements, business contracts)

- Procedures for testing controls

- Due diligence procedures

- Audit procedures for Computer Assisted Audit Techniques (CAATs)

What is the difference between an audit and a review procedure?

There are two key differences between audit and review procedures:

- Assertions

- Type of test

While audit procedures include an assertion that the auditor tests, review procedures do not. In an audit procedure, you must explain why the line item you are testing has a higher risk of material misstatement and link that risk to an assertion before you provide the steps to test it. In a review procedure, you simply need to explain why the line item is an area where a material misstatement is likely to occur and provide the steps to test it.

Audit and review procedures also differ in the types of tests performed:

| Audit procedure tests | Review procedure tests |

| Physical inspection Observation of client procedures Confirmation from external parties ReperformanceExamination of documents Inquiry * Analytical procedures * *In conjunction with another audit procedure | Inquiry Analytical procedures (reliance on management representations) |

In a review procedure, you are limited to asking the client questions and performing an analysis of financial data. You should not be performing audit-type tests in a review procedure unless you explicitly state that you are choosing to do so because of an unusually high-risk scenario. In the same way, you should not rely exclusively on review-type procedures when designing audit procedures. If you choose to use inquiry or analytical procedures as part of an audit procedure, this must be coupled with another audit test to obtain reliable audit evidence.

How do you write an audit procedure?

A traditional audit procedure is the most commonly tested procedure on both Day 2 and Day 3 of the CFE and involves three key elements:

- Explain the risk

- Link the risk to an assertion

- Provide the steps to test

Explain the risk

You must start your procedure with the risk because this is the foundation for the other aspects of the procedure. This step relies entirely on case facts. Using the facts of the case, explain why the financial statement item is at a high risk of material misstatement. If your audit procedure is in response to an accounting issue you discussed, you can also link back to your previously performed accounting analysis.

Example: “There is a risk the financial statements are materially misstated because the controller recognized the vehicle leases as an operating lease but should be treated as a capital lease as previously discussed.”

Link the risk to an assertion

This step must be done after you have identified the risk. Review your risk statement and determine which assertion is most impacted by the scenario. Stay focused on only one assertion and do not attempt to address multiple assertions at once. When candidates attempt to list too many assertions in a single procedure, they often lose focus and fail to develop depth in any of them.

Example: “Assertion – Classification”

Provide steps to test

Your steps to test the identified risk must be sufficiently specific. Consider what actions need to be taken (e.g., inspect, reperform, confirm) and what supporting documentation will be used (e.g., general ledger, invoice, shipping document) to test the risk and assertion identified.

However, do not confuse volume with depth. You want to concisely develop depth so you can achieve breadth by addressing enough audit procedures.

As you explain the steps, consider:

- What documents are needed

- What tests will be performed

- How the auditor will complete each step

- How the auditor will use the results of the test

Example: “The auditor will examine the lease agreement to understand the terms. Using the agreement terms, they will reperform the ASPE criteria calculations to assess whether it is a capital or operating lease (i.e., payments as a percent of asset value, length as a percent of useful life) and compare the results to the general ledger to see if it was correctly recorded.”

How do I write a review procedure?

The process for writing review procedures is the same as the steps described above for audit procedures, only you should not include an assertion to be tested. A review procedure is limited to explaining why the financial statement item is an area where a material misstatement is likely to occur and providing specific steps to test this item including what documents the practitioner will need to obtain.

What should I do if I am struggling to remember the audit assertions?

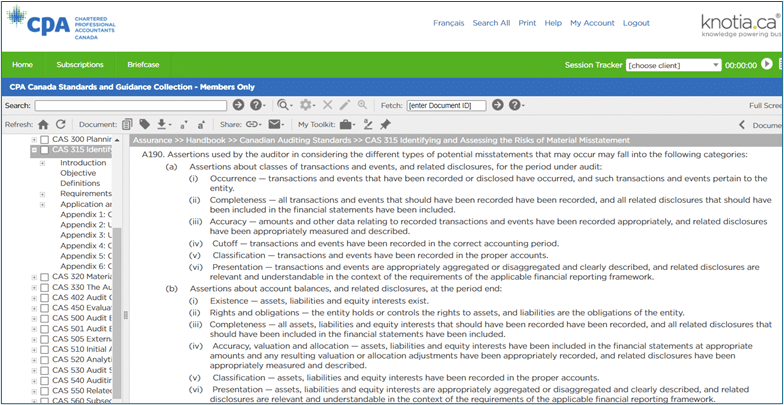

Some candidates struggle to remember the assertions and their definitions. While it is advised you memorize the assertions, you can instead remember where they are in the Handbook. You can quickly navigate to a concise list of the assertions and their descriptions by visiting CAS 315 and clicking on the navigation link at the top of the standard for paragraph 184. From there, you can easily scroll to paragraph 190 to find the relevant information:

Notice in this image of the standards that there are two distinct types of assertions:

| Audit assertions for classes of transactions and events found on the Statement of Earnings and related disclosures | Audit assertions for account balances found on the Statement of Financial Position and related disclosures |

| Occurrence Completeness Accuracy Cutoff Classification Presentation | Existence Rights and obligations Completeness Accuracy Valuation or allocation Classification Presentation |

It will be important when designing your audit procedures to select assertions for the relevant financial statement to demonstrate to the marker you understand the principles you are applying.

Can I memorize common procedures for accounting issues?

One issue is never tested in exactly the same way twice. The case facts, the reason for the risk, or the most critical assertion to test may differ from case to case, or you may be providing procedures for an entirely different type of engagement. You do not want to have memorized the audit procedure for inventory valuation only to find your CFE is testing review procedures for inventory or compliance with the terms in an agreement to purchase inventory. The Board of Examiners has commented weak candidates often provide procedures that could relate to any other case, so avoid memorizing procedures.

Instead, as you debrief your practice cases, understand why each element of the procedure is present. Where did the information come from in the case? Why is the assertion relevant? Why is this a higher risk? What type of engagement is this procedure for? This will fine-tune your skills of developing specific and practical procedures tailored to the case you are writing so you can walk into the CFE with confidence. If you are struggling to provide sufficient procedures, consider keeping a list of sample procedures organized by financial reporting issue. You do not want to memorize these to apply to every case you write, but having the list will make you more familiar with common procedures and documents that you can adapt to the case facts you encounter.

While common, procedures are an area where candidates continue to struggle to score Competent. To help you prepare, we have designed approach and technical materials in the Densmore Scenario Flowcharts Workbook and in our Skill Drills which are both included in our CFE Prep course.